Have you ever wondered how to protect yourself from unexpected financial losses when your vehicle is totaled? Understanding the nuances of a gap waiver can be crucial for anyone financing or leasing a car. It's not just about driving off the lot; it's about ensuring you're covered in case life throws a curveball.

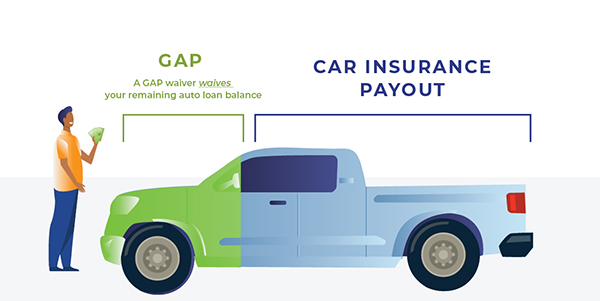

A gap waiver offers a safety net, bridging the gap between what you owe on your vehicle and its actual cash value at the time of loss. But what exactly does this mean for you? The details can be a bit murky, and many people overlook this important aspect of their auto financing.

In this article, we will explore the ins and outs of a gap waiver, its benefits, and how it differs from other forms of coverage. By the end, you'll have a clearer understanding of why this protection might be essential for your peace of mind.

Join us as we delve into what is a gap waiver and discover how it can safeguard your finances when you need it most.

Table of Contents

ToggleUnderstanding GAP Waivers

What Does a GAP Waiver Cover?

A Guaranteed Asset Protection(gap waiver) is designed to protect you from the financial burden of owing more on your vehicle than its current market value. This situation often arises when a car is totaled in an accident.

Here are some key aspects of what a gap waiver covers:

- The difference between your vehicle's loan balance and its actual cash value.

- Protection against depreciation, which can significantly reduce your car's value over time.

- Coverage for negative equity if you rolled over debt from a previous vehicle into your new loan.

How GAP Waivers Work

When your vehicle is declared a total loss, the process of claiming a gap waiver can be straightforward. Here’s how it typically works:

- You report the incident to your insurance company and file a claim for the total loss.

- Your insurer pays out the actual cash value of the vehicle, which may be less than what you owe.

- You submit the necessary documentation to claim the gap waiver, covering the remaining balance.

Documentation often includes your loan agreement, insurance payout details, and any other relevant paperwork. Ensuring you have these ready can expedite the claims process.

Benefits of Having a GAP Waiver

Financial Protection

One of the primary benefits of a gap waiver is financial protection. It ensures that you are not left with a significant debt after your vehicle is declared a total loss.

Without this protection, you could find yourself owing thousands of dollars, especially if your car depreciates quickly. A gap waiver helps cover this difference, providing essential support during a challenging time.

Peace of Mind

Having a gap waiver in place offers peace of mind. You can drive your vehicle knowing that if the unexpected happens, you have a safety net to fall back on.

This emotional assurance can be invaluable, allowing you to focus on enjoying your vehicle rather than worrying about potential financial pitfalls.

Cost-Effectiveness

A gap waiver is often a cost-effective option compared to the potential losses you might face. The small premium you pay for this coverage can save you from significant financial strain later.

In many cases, the cost of a gap waiver is relatively low, making it an attractive option for those financing or leasing vehicles. Weighing the cost against potential debt can highlight its value.

GAP Waiver vs. GAP Insurance

Key Differences

While both gap waivers and gap insurance serve similar purposes, they are not the same. Understanding their differences can help you make an informed decision about your coverage options.

- Gap Waivers: Typically offered by dealerships or lenders, these waivers cover the difference between your vehicle's loan balance and its actual cash value in case of a total loss.

- Gap Insurance: This is a standalone policy purchased from an insurance provider, which also covers the gap but may include additional features and benefits.

Which Option is Better?

The choice between a gap waiver and gap insurance depends on your individual needs and circumstances. Here are some factors to consider:

- If you prefer simplicity and want coverage included in your financing agreement, a gap waiver might be suitable.

- If you want a more comprehensive policy that may cover additional scenarios, gap insurance could be the better option.

Ultimately, evaluating your financial situation and how each option aligns with your needs will guide you in making the right choice.

Example Case Studies

Case Study 1: The Financial Burden of Not Having a GAP Waiver

Consider the story of Sarah, who financed a new car without a gap waiver. When her vehicle was totaled in an accident, she was left owing $8,000, significantly more than the insurance payout. This unexpected debt caused financial stress.

Case Study 2: A Successful Claim Experience

In contrast, John purchased a gap waiver when he leased his vehicle. After an accident resulted in a total loss, his insurance covered the car's value, and the gap waiver paid off the remaining balance on his loan. John felt relieved and financially secure.

Case Study 3: Comparing Two Scenarios

Lastly, let's look at two friends, Mike and Tom. Mike opted for a gap waiver, while Tom did not. When both faced total losses, Mike had no outstanding debt, while Tom struggled to cover his remaining loan balance. This illustrates the importance of considering a gap waiver.

How to Obtain a GAP Waiver

Where to Purchase

Obtaining a gap waiver can be done through several channels. Most commonly, you can purchase it directly from:

- Your car dealership when finalizing your vehicle purchase.

- Your lender or financial institution during the financing process.

- Some insurance companies that offer it as an add-on to your auto policy.

Cost Considerations

The cost of a gap waiver can vary significantly based on several factors, including the vehicle's value and the lender's policies. Generally, it is a one-time fee added to your loan amount or a small monthly charge.

It is essential to evaluate this cost against the potential financial protection it offers. In many cases, the peace of mind provided by a gap waiver far outweighs its expense.

Questions to Ask Before Purchasing

Before committing to a gap waiver, consider asking these important questions:

- What specific coverage does the waiver provide?

- Are there any exclusions or limitations I should be aware of?

- How do I file a claim if I need to use the waiver?

Getting clear answers to these questions can help ensure that you choose the right protection for your needs.

Frequently Asked Questions - FAQS

Q. What is a gap waiver in car insurance?

A. A gap waiver in car insurance is a provision that covers the difference between what you owe on your vehicle and its actual cash value if it is totaled or stolen. This protects against financial loss.

Q. How does a gap waiver work in auto insurance?

A. A gap waiver works by paying off the remaining balance of your auto loan after your insurance company settles the claim for the vehicle's actual cash value, ensuring you are not left with debt.

Q. Is a gap waiver worth it for new cars?

A. Yes, a gap waiver is often worth it for new cars due to rapid depreciation. It provides financial protection against owing more than the car's worth if it is totaled shortly after purchase.

Q. Do I need a gap waiver for a used car loan?

A. While not mandatory, a gap waiver can be beneficial for used car loans, especially if the vehicle has a low down payment or high depreciation rate, protecting you from potential financial gaps.

Q. What is the difference between gap insurance and a gap waiver?

A. The main difference is that gap insurance is purchased separately from an insurance provider, while a gap waiver is typically included in your auto loan agreement, covering similar financial protection needs.

Q. How much does a gap waiver cost for a car loan?

A. The cost of a gap waiver typically ranges from $400 to $700, depending on the lender and vehicle value. This fee can often be rolled into your loan amount for convenience.

Q. Can I cancel a gap waiver after purchasing it?

A. Yes, you can cancel a gap waiver after purchasing it, typically at any time. Some lenders may offer partial refunds based on how long you had the coverage before cancellation.

Q. When should I buy a gap waiver for my car?

A. It is best to buy a gap waiver when financing or leasing your vehicle, ideally at the time of purchase to ensure coverage from the start in case of total loss.

Q. Is a gap waiver necessary for a leased vehicle?

A. Yes, a gap waiver is often necessary for leased vehicles since lessees are responsible for the full value of the lease agreement and may face significant financial gaps if the vehicle is totaled.

Q. How long does a gap waiver last on a car loan?

A. A gap waiver lasts as long as your auto loan remains active, typically until the loan balance reaches zero or until you pay off the vehicle through refinancing or sale.

Q. Do I need a gap waiver if I have full coverage insurance?

A. Yes, even with full coverage insurance, a gap waiver is beneficial because full coverage only pays the actual cash value of your vehicle, which may be less than what you owe on your loan.

Q. Can I get a gap waiver after financing a car?

A. Yes, you can obtain a gap waiver after financing your car by refinancing your loan and including the gap waiver in the new financing agreement to protect against future losses.

Q. Is a gap waiver required by lenders?

A. A gap waiver is generally not required by lenders but may be recommended for certain loans or leases to protect against financial risks associated with depreciation and total loss.

Q. What happens if I total my car with a gap waiver?

A. If you total your car with a gap waiver, your insurance will pay out the actual cash value, and the gap waiver will cover any remaining balance owed on your auto loan, preventing financial loss.

Q. How does a gap waiver affect my car insurance premium?

A. A gap waiver typically does not affect your car insurance premium directly since it is separate coverage related to your auto loan rather than part of your standard auto insurance policy.

Q. Can I get a gap waiver for a motorcycle loan?

A. Yes, some lenders offer gap waivers for motorcycle loans, providing similar protection as with auto loans by covering the difference between what you owe and the motorcycle's actual cash value.

Q. Is a gap waiver transferable to a new owner?

A. Generally, a gap waiver is not transferable to a new owner when selling or trading in your vehicle; it typically remains tied to the original financing agreement.

Q. Can I get a gap waiver for a commercial vehicle?

A. Yes, many lenders provide gap waivers for commercial vehicles as well, helping businesses protect against financial losses due to depreciation and total loss situations.

Q. What are the tax implications of a gap waiver?

A. The tax implications of a gap waiver depend on local laws; generally, any benefits received from it are not taxable as income since it serves as debt cancellation rather than income generation.

Q. How do I file a claim with a gap waiver?

A. To file a claim with a gap waiver, contact your lender or financing institution after totaling your vehicle and provide necessary documentation such as police reports and insurance payout details to initiate coverage.

Conclusion

Recap of Key Points

In summary, understanding a gap waiver is essential for anyone financing or leasing a vehicle. It provides crucial financial protection by covering the difference between your loan balance and the actual cash value of your car.

We explored the various benefits, including peace of mind and cost-effectiveness, as well as the differences between a gap waiver and gap insurance. Real-life case studies illustrated how these protections can impact your financial well-being.

Final Thoughts

As you consider your options, think about your individual circumstances and whether a gap waiver aligns with your needs. Evaluating this coverage can help safeguard you from unexpected financial burdens in the event of a total loss.

Taking proactive steps now can lead to greater security on the road ahead. Be informed, ask questions, and make choices that protect your financial future.