When it comes to protecting your vehicle investment, understanding the ins and outs of insurance can be a bit overwhelming. One term that often comes up is GAP insurance, which plays a crucial role for many car owners.

Have you ever wondered what happens if your car is totaled and you still owe more than its current value? This is where GAP insurance steps in, offering peace of mind during uncertain times. In the USA, several insurance companies provide this essential coverage.

In this article we will explore some of the Insurance Companies Offering GAP Insurance In USA, also we will explore the leading providers and what sets them apart. By the end, you’ll have a clearer understanding of your options and how to safeguard your financial future.

Join us as we uncover the details of What Insurance Companies Offer GAP Insurance In USA?, empowering you to make informed decisions about protecting your investment.

Table of Contents

ToggleGAP Insurance On A Vehicle

How GAP Insurance Works

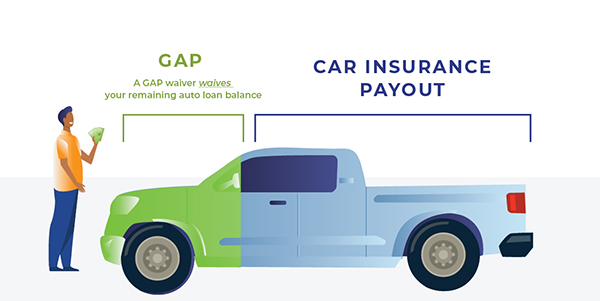

GAP insurance - Guaranteed Asset Protection is designed to cover the difference between your vehicle's current market value and the amount you still owe on your auto loan or lease. This coverage becomes vital if your car is declared a total loss.

The Depreciation Factor

Vehicles typically depreciate quickly, often losing a significant portion of their value in the first few years. Without GAP insurance, you may find yourself in a financially vulnerable position if an accident occurs.

Benefits of Having GAP Insurance

- Financial Security: GAP insurance provides peace of mind by ensuring you are not left with a hefty bill after a total loss.

- Protection Against Depreciation: This coverage helps protect you from the rapid depreciation that new cars experience.

- Peace of Mind: Knowing that you have a safety net can alleviate stress, allowing you to enjoy your vehicle more fully.

Who Should Consider GAP Insurance?

If you have a small down payment, are leasing your vehicle, or have a long-term loan, it’s wise to consider GAP insurance. This coverage is particularly beneficial for those who want to safeguard their financial investment.

Leading Insurance Companies Offering GAP Insurance

1. Progressive Mutual Insurance Company

2. The Allstate Corporation

Coverage Details

Allstate’s GAP insurance includes benefits like accident forgiveness and a variety of discounts for safe drivers, making it an attractive choice for many car owners.

3. State Farm Mutual Automobile Insurance Company

State Farm is one of the largest providers of auto insurance in the USA and offers competitive GAP insurance options. Their customer service and local agent support are highly rated.

Customer Feedback

Many customers appreciate State Farm's straightforward claims process and the ability to work with local agents who understand their needs. This personal touch can make a significant difference.

4. AAA (The American Automobile Association, Inc)

AAA not only provides roadside assistance but also offers comprehensive GAP insurance coverage for its members. Their policies are tailored to meet the needs of vehicle owners.

Membership Benefits

AAA members often enjoy exclusive discounts on insurance premiums, making their GAP insurance an economical choice for those who value both coverage and savings.

5. Nationwide Mutual Insurance Company

Nationwide offers GAP insurance as part of its auto policy options. They provide coverage that helps protect you from negative equity in your vehicle.

Eligibility Criteria

To qualify for Nationwide's GAP insurance, you typically need to have an existing auto policy with them. This bundling can lead to additional savings on your overall insurance costs.

Comparison Table of Top Providers

Understanding the Differences

When choosing a provider for GAP insurance, it is essential to compare the features and benefits each company offers. Below is a comparison table highlighting key aspects of the top providers.

Comparison Table

| Company | Coverage Type | Unique Features | Customer Rating |

|---|---|---|---|

| Progressive | Loan/Lease Payoff | Automatic monthly deductions | High |

| Allstate | Guaranteed Asset Protection | Accident forgiveness | Moderate |

| State Farm | Standard GAP Insurance | Local agent support | High |

| AAA | Comprehensive Coverage | Member discounts | High |

| Nationwide | Negative Equity Coverage | Must have existing auto policy | Moderate |

Selecting the Right Provider

Selecting the right provider for your GAP insurance involves considering your personal needs and preferences. Look for factors such as coverage options, customer service, and overall reputation in the industry.

Your Financial Situation Matters

Your financial situation plays a crucial role in this decision. Ensure that the policy you choose aligns with your budget while providing adequate protection against potential losses.

The Importance of Research

Conducting thorough research on each provider can help you make an informed choice. Reading customer reviews and comparing quotes will give you a clearer picture of what to expect from each company.

Case Studies - the Need for GAP Insurance

Case Study 1: The New Car Buyer

Imagine a new car buyer who puts down a small down payment on a vehicle. After just a few months, they are involved in an accident that totals the car. Without GAP insurance, they face a significant financial loss.

The Financial Impact

In this scenario, the car's depreciated value is much lower than the remaining loan balance. The buyer ends up owing thousands, highlighting the importance of having GAP insurance to cover that difference.

Case Study 2: The Leased Vehicle Owner

A leased vehicle owner drives off the lot with a brand-new car. Unfortunately, after a few years, the car is stolen. Without GAP insurance, they are responsible for paying the remaining lease balance.

Understanding Lease Agreements

Leasing agreements often require you to pay the full amount owed, even if the vehicle is no longer in your possession. GAP insurance would cover this gap, preventing unexpected expenses.

Case Study 3: The Long-Term Loan Holder

Consider someone with a long-term auto loan who buys a vehicle that depreciates rapidly. After an accident, they discover that their car's value has plummeted, leaving them with negative equity.

The Risk of Negative Equity

This case illustrates why GAP insurance is essential for long-term loan holders. It protects against the financial burden of owing more than what the vehicle is worth after an accident.

Frequently Asked Questions - FAQS

Q. Best car insurance companies offering GAP coverage in California

A. In California, the top car insurance companies offering GAP coverage include Progressive, Allstate, and Farmers. Progressive is known for its competitive rates, making it a popular choice among drivers seeking affordable options.

Q. What is the best GAP insurance provider for new car buyers in Texas?

A. For new car buyers in Texas, Progressive and State Farm are considered the best GAP insurance providers. They offer comprehensive coverage options tailored to protect against depreciation and financial loss after a total loss.

Q. Which insurance companies offer GAP coverage for leased vehicles in Florida?

A. In Florida, major insurers like State Farm, Progressive, and Allstate provide GAP coverage for leased vehicles. These companies help cover the difference between the vehicle's value and the remaining lease balance if totaled.

Q. Can I get GAP insurance from my current auto insurance provider in New York?

A. Yes, many auto insurance providers in New York offer GAP insurance as an add-on to existing policies. It's advisable to check with your current insurer to see if they provide this coverage option.

Q. How much does GAP insurance cost per month with State Farm?

A. The cost of GAP insurance with State Farm typically ranges from $20 to $30 per month. Pricing may vary based on factors such as your vehicle's value and your overall policy details.

Q. Does Progressive offer GAP insurance for used cars in Michigan?

A. Yes, Progressive provides GAP insurance for used cars in Michigan, but eligibility may depend on the vehicle's age and financing terms. It's best to consult with a Progressive agent for specific details.

Q. What is the best way to get GAP insurance for a financed car in Illinois?

A. The best way to obtain GAP insurance for a financed car in Illinois is to contact your current auto insurer or shop around for quotes from different providers to find the most suitable policy.

Q. Does Geico offer GAP insurance for leased cars in Pennsylvania?

A. Geico does not directly offer GAP insurance, but they do provide options through partnerships with other insurers for leased cars in Pennsylvania, helping cover any financial gaps if the vehicle is totaled.

Q. How can I compare GAP insurance quotes from different companies in Ohio?

A. To compare GAP insurance quotes in Ohio, use online comparison tools or contact multiple insurers directly. Gathering several quotes will help you find the best coverage at an affordable price.

Q. What is the average cost of GAP insurance for a $30,000 car in Georgia?

A. The average cost of GAP insurance for a $30,000 car in Georgia typically ranges from $20 to $50 per month, depending on the insurer and specific policy details you choose.

Q. Can I add GAP insurance to my existing policy with Allstate in Virginia?

A. Yes, you can add GAP insurance to your existing Allstate policy in Virginia by contacting your agent or customer service representative to discuss your options and any additional costs involved.

Q. Does USAA offer GAP insurance for military members in North Carolina?

A. Yes, USAA offers GAP insurance specifically designed for military members in North Carolina, providing valuable protection against financial loss due to vehicle depreciation after a total loss.

Q. What are the best GAP insurance options for a new car lease in Arizona?

A. The best GAP insurance options for a new car lease in Arizona include providers like State Farm and Progressive, which offer competitive rates and comprehensive coverage tailored to leased vehicles.

Q. How long does GAP insurance coverage last in Washington State?

A. In Washington State, GAP insurance coverage typically lasts until the loan or lease balance is paid off or until the vehicle is no longer financed or leased, whichever comes first.

Q. Can I get GAP insurance for a used car with high mileage in Colorado?

A. Yes, you can obtain GAP insurance for a used car with high mileage in Colorado; however, availability may vary by insurer and depend on specific underwriting guidelines.

Q. Does Farmers Insurance offer GAP coverage for motorcycles?

A. Farmers Insurance does not typically offer GAP coverage specifically for motorcycles in South Carolina; their focus is primarily on auto loans and leases rather than motorcycle financing.

Q. What is the best way to cancel GAP insurance?

A. To cancel GAP insurance in Nevada, contact your insurer directly via phone or online and request cancellation instructions while ensuring you receive confirmation of the cancellation.

Q. Can I get GAP insurance for a car loan with bad credit?

A. Yes, you can obtain GAP insurance even with bad credit in New Jersey; however, premiums may be higher due to perceived risk factors associated with your credit history.

Q. Does AAA offer GAP insurance for its members in Massachusetts?

A. Yes, AAA offers GAP insurance, providing its members in Massachusetts with valuable protection against financial losses associated with vehicle depreciation after an accident or theft.

Q. What is the difference between GAP insurance and extended warranty?

A. The main difference is that GAP insurance covers the difference between what you owe on your vehicle and its actual cash value after a total loss, while an extended warranty covers repair costs after factory warranty expiration.

Conclusion

Recap of Key Points

Throughout this article, we explored the importance of GAP insurance and how it protects car owners from financial loss in the event of a total loss. Understanding your options is crucial.

Choosing the Right Provider

We examined several leading insurance companies that offer GAP insurance, highlighting their unique features and benefits. Each provider has something different to offer, making it essential to evaluate your specific needs.

Call to Action

As you consider your options, take the time to compare quotes and read customer reviews. This research will help you make an informed decision about which GAP insurance policy aligns best with your financial situation.

Protect Your Investment

Ultimately, having GAP insurance can provide peace of mind and protect your investment in your vehicle. By understanding the risks and benefits, you can safeguard yourself against unexpected financial burdens.