When it comes to protecting your vehicle investment, many car owners overlook a crucial aspect: gap insurance. You might be wondering, what exactly is it and why does it matter? If you find yourself in an accident or your car is stolen, the implications can be significant.

Without the right coverage, you could face unexpected financial burdens that leave you questioning your decisions. This brings us to the question: What Happens If You Don't Have Gap Insurance? Understanding the risks associated with not having this coverage is essential for every driver.

In this article, we will explore the potential consequences of going without gap insurance and how it can impact your financial security. From total loss scenarios to the obligations that come with auto loans, it's important to be informed.

Join us as we dive into what happens if you don't have gap insurance, and discover how to safeguard your finances against unforeseen events.

Table of Contents

ToggleUnderstanding Gap Insurance

How Gap Insurance Works

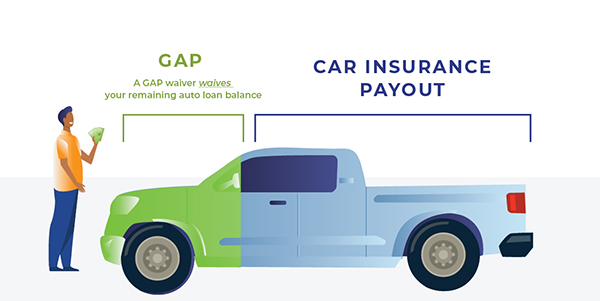

Gap insurance is designed to cover the difference between your vehicle's actual cash value and the remaining balance on your auto loan or lease. This coverage becomes crucial when your car is declared a total loss due to an accident or theft.

Who Needs Gap Insurance?

Not everyone requires gap insurance, but certain individuals should strongly consider it. Here are some scenarios where gap insurance is particularly beneficial:

- New car buyers: Those who purchase a new vehicle often face rapid depreciation.

- Leased vehicles: Lessees typically have higher loan balances compared to the car's value.

- Low down payment: Buyers who make a small down payment may owe more than the car is worth.

- High-interest loans: If you have a loan with a high interest rate, gap insurance can provide essential protection.

Common Misconceptions

Many people believe that having full coverage insurance eliminates the need for gap insurance. However, this is not always true. Full coverage typically covers the vehicle's market value, which may still leave you with a financial gap if your car is totaled.

Another misconception is that gap insurance is too expensive. In reality, it often costs less than expected compared to the potential financial burden of being left with an unpaid loan after a total loss.

What Happens If You Don’t Have Gap Insurance? - Financial Risks

Not having gap insurance can lead to significant financial burdens. If your car is totaled or stolen, you may end up owing more on your loan than the vehicle's actual cash value, creating a substantial gap.

Total Loss Scenarios

Understanding the financial risks of not having gap insurance is vital. In the event of a total loss, such as an accident or theft, you may find yourself in a precarious situation. The insurance payout often does not cover the remaining loan balance.

Loan Repayment Obligations

When your vehicle is declared a total loss, the insurance company typically pays only the current market value of the car. If this amount is less than what you owe on your auto loan, you are left responsible for the difference.

This situation can lead to significant financial strain, especially if you are already managing other expenses. Here are some potential outcomes:

- Out-of-pocket payments: Without gap insurance, you are solely responsible for paying off the remaining loan balance. This can be particularly challenging if your vehicle depreciates quickly, leaving you with unexpected out-of-pocket expenses.

- Debt accumulation: If unable to pay, this debt can accumulate and impact your credit score.

- Financial stress: The unexpected burden can lead to anxiety and financial instability.

Impact on Credit Score

Failing to cover the remaining loan balance after a total loss can have serious repercussions on your credit score. Unpaid loans or missed payments can lead to a decline in your creditworthiness.

A lower credit score can affect future borrowing opportunities, making it more challenging to secure loans or favorable interest rates. Protecting your credit should be a priority, and gap insurance can help mitigate these risks.

Lack of Coverage for Theft

If your vehicle is stolen and you lack gap insurance, you will only receive compensation based on the car's market value. This may not cover the outstanding loan balance, leaving you financially vulnerable.

Case Studies

Case Study 1: New Car Owner Without Gap Insurance

Consider a new car owner who purchases a vehicle for $30,000. After a year, the car is involved in an accident and declared a total loss. The insurance company offers $20,000 based on its current market value.

With an outstanding loan balance of $25,000, the owner is left with a $5,000 debt. This situation highlights the financial risk of not having gap insurance to cover that difference.

Case Study 2: Leased Vehicle Scenario

A lessee drives a car valued at $28,000 with a lease agreement. After six months, the vehicle is stolen. The insurance payout is only $18,000, which does not cover the remaining lease obligation of $22,000.

The lessee must pay the remaining $4,000 out of pocket, illustrating how gap insurance can protect against such losses in leased vehicles.

Case Study 3: Comparison of Two Individuals

Imagine two individuals, Alex and Jamie. Alex has gap insurance while Jamie does not. Both own cars worth $25,000 with loans of $30,000. After accidents leave both cars totaled, their experiences differ significantly.

- Alex's scenario: With gap insurance, Alex's insurer covers the $5,000 difference between the loan and payout.

- Jamie’s scenario: Jamie must pay the same amount out of pocket, leading to financial strain and debt.

This comparison underscores the importance of gap insurance in protecting against unexpected financial burdens.

Alternatives to Gap Insurance

Full Coverage Insurance Options

While full coverage insurance is essential, it may not fully replace the need for gap insurance. Full coverage typically includes liability, collision, and comprehensive coverage, but it only pays the market value of your car.

If your vehicle is totaled, the payout may still leave you with a financial gap. Therefore, understanding the limitations of full coverage is crucial for financial protection.

Emergency Savings Fund

Building an emergency savings fund can serve as a safety net when unexpected situations arise. Setting aside funds specifically for potential vehicle losses can help cover any outstanding loan balances.

Here are some tips for creating an effective savings strategy:

- Set a monthly savings goal: Aim to save a specific amount each month dedicated to this fund.

- Automate your savings: Use automatic transfers to ensure consistent contributions.

- Review and adjust regularly: Monitor your progress and adjust your goals as needed.

Negotiating Loan Terms

Another alternative to consider is negotiating better terms on your auto loan. Lower interest rates or extended loan periods can reduce the amount you owe compared to your vehicle's value.

This approach can minimize the risk of financial loss in case of a total loss. Always explore options with your lender to find the best terms that suit your financial situation.

Frequently Asked Questions - FAQS

Q. What happens if my car is totaled and I don’t have gap insurance?

A. If your car is totaled without gap insurance, your standard insurance will pay only the vehicle's current market value. You will still owe the remaining balance on your loan, leading to potential financial strain.

Q. Do I need gap insurance if I finance my car?

A. Yes, gap insurance is advisable if you finance your car, especially with a low down payment. It protects you from owing more than your car's value in case of a total loss.

Q. What is the difference between gap insurance and comprehensive insurance?

A. Gap insurance covers the difference between your loan balance and the car's value after a total loss, while comprehensive insurance covers damages from non-collision incidents like theft or natural disasters.

Q. Is gap insurance worth it for used cars?

A. Gap insurance can be beneficial for used cars with significant loans compared to their market value. If your loan exceeds the car's worth, gap insurance offers essential financial protection.

Q. Can I get gap insurance after I buy a car?

A. Yes, you can purchase gap insurance after buying a car, but it's best to do so soon after purchase. Many insurers allow you to add it within a specific time frame post-purchase.

Q. How much does gap insurance cost per month?

A. The cost of gap insurance typically ranges from $20 to $50 per month, depending on factors like the vehicle's value and the insurer's pricing structure. It's often considered affordable coverage.

Q. What is the best time to buy gap insurance?

A. The ideal time to buy gap insurance is when you purchase a new or financed vehicle, ideally within the first few months of ownership, as this is when vehicles depreciate most rapidly.

Q. Does gap insurance cover theft?

A. Yes, gap insurance covers theft by paying the difference between what your comprehensive insurance pays for the stolen vehicle and what you still owe on your loan or lease.

Q. Is gap insurance necessary for a leased car?

A. Yes, gap insurance is often required for leased cars as it protects both you and the leasing company from financial loss in case of a total loss or theft.

Q. Can I cancel gap insurance early?

A. Yes, you can cancel gap insurance early at any time, but check with your insurer about potential refunds or fees associated with early cancellation.

Q. What is the downside of gap insurance?

A. The downside of gap insurance includes its additional cost and potential redundancy if you have sufficient equity in your vehicle or if your loan balance is lower than its market value.

Q. How long does gap insurance last?

A. Gap insurance typically lasts until your loan balance equals your vehicle's actual cash value or until the vehicle is paid off, whichever comes first.

Q. Does gap insurance cover flood damage?

A. No, gap insurance does not cover flood damage; it only addresses the difference between your loan balance and what standard auto insurance pays after a total loss.

Q. Can I get gap insurance if I have bad credit?

A. Yes, having bad credit does not prevent you from obtaining gap insurance; however, it may affect your overall premium rates depending on the insurer's policies.

Q. What is the difference between gap insurance and extended warranty?

A. Gap insurance covers financial losses in case of a total loss of the vehicle, while an extended warranty provides coverage for mechanical failures and repairs beyond the manufacturer's warranty period.

Q. Does gap insurance cover mechanical breakdowns?

A. No, gap insurance does not cover mechanical breakdowns; it specifically addresses financial gaps related to total losses from accidents or theft.

Q. Can I get gap insurance on a motorcycle?

A. Yes, some insurers offer gap insurance for motorcycles; however, availability may vary by provider and specific policy terms should be reviewed carefully.

Q. Is gap insurance tax deductible?

A. Generally, personal auto expenses including gap insurance are not tax deductible; however, if used for business purposes, you may be able to deduct it under certain conditions.

Q. What happens if I refinance my car and have gap insurance?

A. If you refinance your car and have gap insurance, it typically remains in effect unless canceled; however, it's wise to inform your insurer about changes in loan terms.

Q. Can I get gap insurance on a used car with high mileage?

A. Yes, you can obtain gap insurance on a used car with high mileage as long as there is still a significant loan balance compared to its current market value.

Conclusion

Recap of Importance

In summary, understanding the implications of not having gap insurance is essential for every vehicle owner. Without this coverage, you could face significant financial challenges in the event of a total loss.

The potential for owing money on a vehicle that is no longer usable can lead to stress and financial instability. It is crucial to weigh the benefits of gap insurance against the risks of being underinsured.

Final Thoughts on Coverage Decisions

As you consider your options, take time to evaluate your personal circumstances regarding gap insurance. Assess your financial situation, vehicle value, and loan obligations to determine if this coverage is right for you.

Ultimately, being informed about your choices can help you make decisions that protect your financial future. Whether through gap insurance or alternative strategies, ensuring you are adequately covered is key to peace of mind.