In today's fast-paced world, managing finances can be a daunting task. Many people find themselves in need of quick, flexible solutions that traditional banks might not offer. This is where innovative financing options come into play, providing alternatives to conventional credit.

One such option is Snap Finance, a service designed to help individuals access funds without the usual hurdles. Understanding how it works can be crucial for those looking for flexible financing solutions, especially if they have limited credit history.

If you've ever wondered about the possibilities of financing without the stress of credit checks, you're not alone. In this article, we will explore how does Snap Finance work, its benefits, and real-life scenarios that illustrate its impact.

Join us as we discuss into how does Snap Finance work, exploring its unique features and advantages that can empower you to take control of your financial journey.

Table of Contents

ToggleWhat Is Snap Finance?

Definition and Purpose

Snap Finance is an innovative financing solution designed to provide consumers with flexible payment options. It allows individuals to make purchases without the burden of traditional credit checks, making it accessible to a broader audience.

This service primarily targets those with limited or no credit history, offering a way to acquire essential items while building financial confidence. By focusing on lease-to-own agreements, Snap Finance empowers users to take control of their financial decisions.

Key Features of Snap Finance

- No Credit Check: Unlike traditional lenders, Snap Finance does not require a credit check, making it easier for consumers with poor credit ratings to qualify.

- Flexible Payments: Users can choose from various repayment plans tailored to their financial situations, allowing for manageable monthly payments.

- Quick Approval: The application process is streamlined, often providing instant approval, so customers can make purchases without delay.

- Wide Acceptance: Many retailers partner with Snap Finance, making it a versatile option for purchasing everything from electronics to furniture.

The Target Audience

Snap Finance is particularly beneficial for individuals who may feel excluded from traditional financing options. This includes young adults just starting their credit journey and those recovering from financial setbacks. By focusing on inclusivity, Snap Finance aims to redefine access to essential goods.

This approach not only fosters financial independence but also encourages responsible spending habits among users. With Snap Finance, consumers can make informed choices without the fear of overwhelming debt.

How Snap Finance Works?

Application Process

The application process for Snap Finance is designed to be straightforward and user-friendly. Interested consumers can apply online, making it accessible from the comfort of their homes.

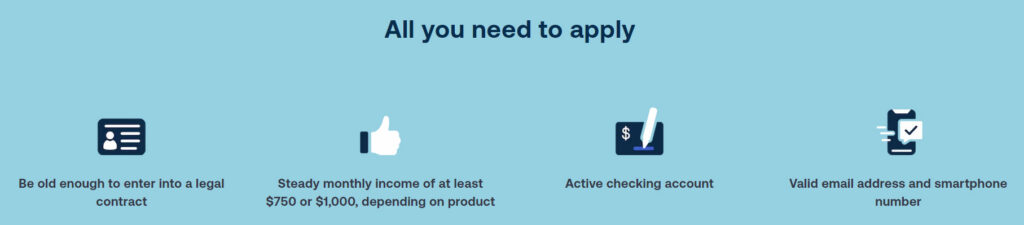

To begin, applicants need to provide basic information, including:

- Name and Contact Information: Essential details to create an account.

- Income Verification: Proof of income helps determine eligibility.

- Bank Account Details: Required for setting up automatic payments.

Approval Process

Once the application is submitted, Snap Finance typically provides an instant decision. This quick approval process is a significant advantage for those eager to make purchases without lengthy waiting periods.

Eligibility criteria are flexible, allowing many individuals to qualify even with bad credit. This inclusivity sets Snap Finance apart from traditional lenders.

Payment Structure

Snap Finance offers a clear and transparent payment structure. Users can choose from various repayment plans that fit their budgets, ensuring manageable monthly payments.

Automatic Payments

To simplify the repayment process, Snap Finance allows for automatic deductions from the user's bank account. This feature helps avoid missed payments and potential late fees.

Early Payoff Options

Customers have the option to pay off their balance early without incurring additional fees. This flexibility encourages responsible financial habits and can save users money in the long run.

No Credit Reporting

Another appealing aspect of Snap Finance is that it does not report to credit bureaus. This means users can enjoy their purchases without worrying about impacting their credit scores.

Snap Finance Store Locator

Snap Finance offers a convenient Store Locator feature that helps customers find nearby retailers where they can use their financing options. By entering a postcode or location, users can quickly access a list of stores along with essential details such as addresses, opening hours, and contact information.

This tool is designed to facilitate both specific product searches and general browsing, ensuring that customers can easily locate the right retailer for their needs.

Click your state to find the stores near you, suported by Snap Finance

For those interested in utilizing Snap Finance's services, the store locator is an essential resource, providing up-to-date information to enhance the shopping experience.

Benefits of Using Snap Finance

Accessibility

One of the most significant advantages of Snap Finance is its accessibility. By eliminating the need for a credit check, it opens doors for individuals who might struggle to secure traditional loans.

This inclusivity empowers consumers with bad credit or no credit history to make necessary purchases without the usual barriers. It levels the playing field in the world of financing.

Flexible Repayment Options

Snap Finance offers various repayment plans tailored to individual needs. This flexibility allows users to select a schedule that aligns with their financial situation.

- Customized Plans: Users can choose payment intervals that suit their budgets, whether weekly, bi-weekly, or monthly.

- Adjustable Amounts: The option to adjust payment amounts based on changing financial circumstances is a valuable feature.

Transparent Cost Structure

The cost structure of Snap Finance is designed to be clear and straightforward. Unlike some traditional financing methods, there are no hidden fees or surprise charges.

Comparison with Traditional Financing

When compared to credit cards and payday loans, Snap Finance often presents a more manageable and transparent option. Users can better understand what they owe and when it is due, reducing financial stress.

No Hidden Fees

Snap Finance prides itself on transparency. Customers can expect straightforward terms without unexpected costs, making it easier to budget for payments.

Snap Finance vs. Traditional Financing

Comparison with Credit Cards

When comparing Snap Finance to credit cards, several key differences emerge. Snap Finance offers a more inclusive approach, especially for those with limited credit history.

Unlike credit cards, which often come with high-interest rates and fees, Snap Finance provides a straightforward payment structure that is easier to manage. This can be particularly beneficial for consumers looking to avoid debt traps.

Comparison with Payday Loans

Payday loans are notorious for their high fees and short repayment terms. In contrast, Snap Finance offers a more sustainable solution with flexible payment options.

- Lower Costs: Snap Finance typically has lower overall costs compared to payday loans, making it a more affordable choice.

- Longer Repayment Periods: Users can spread payments over a longer duration, reducing financial strain.

Consumer Protection Features

Snap Finance includes consumer protection features that are often lacking in traditional financing methods. These features help safeguard users against unexpected financial burdens.

Transparent Terms

The clarity of Snap Finance's terms ensures that users know exactly what they are signing up for. This transparency reduces the likelihood of misunderstandings that can lead to debt.

Support Services

Additionally, Snap Finance offers customer support to assist users with any questions or concerns. This level of service can make a significant difference in the overall experience.

Snap Finance Case Studies

Let us understand how Snap Finance works through real-world examples. Let's explore two distinct case studies that highlight its practical applications and advantages.

Case Study 1: A Young Adult's Essential Purchases

Meet Sarah, a recent college graduate who needed to furnish her new apartment. With limited credit options available, she turned to Snap Finance for help. Here’s how it worked for her:

- Application Process: Sarah applied online and received quick approval without a credit check.

- Flexible Payment Plans: She chose a repayment plan that suited her monthly budget, allowing her to manage expenses effectively.

- Successful Outcome: By using Snap Finance, Sarah was able to purchase essential items without the stress of upfront costs.

Case Study 2: A Family Managing Unexpected Expenses

The Johnson family faced an unexpected car repair that threatened their monthly budget. They decided to use Snap Finance to cover the costs. Here’s how it benefited them:

- No Credit Check: The family was relieved that their credit history would not hinder their ability to access funds.

- Transparent Costs: They appreciated the clear terms and conditions, which helped them understand their financial commitment.

- Positive Impact: With flexible repayment options, the Johnsons managed to keep their finances stable while addressing the urgent repair.

These case studies illustrate the potential of Snap Finance as a viable solution for individuals and families facing financial challenges. By providing access to necessary funds, it empowers users to make informed financial decisions.

Real-Life Applications

Consumer Experiences

Many consumers have shared positive experiences with Snap Finance, highlighting its role in facilitating essential purchases. Users appreciate the ease of access and the flexibility it provides.

For instance, individuals have successfully used Snap Finance to buy items such as:

- Electronics: Laptops, smartphones, and other gadgets are often purchased through Snap Finance, allowing users to stay updated with technology.

- Furniture: Many customers finance furniture for their homes, making it easier to create comfortable living spaces.

- Appliances: Major household appliances can be financed, ensuring that essential items are accessible without upfront costs.

Retail Partnerships

Snap Finance has established partnerships with a variety of retailers, enhancing its reach and usability. This network allows consumers to use Snap Finance at numerous locations.

Diverse Retail Options

From local shops to large retail chains, the range of participating stores is extensive. This variety ensures that users can find what they need while enjoying flexible financing options.

Promotional Offers

Many retailers also provide promotional offers for purchases made through Snap Finance. These incentives can further enhance the value for consumers looking to make significant purchases.

Drawbacks of Snap Finance

While Snap Finance offers many benefits, it is essential to consider potential drawbacks. Understanding these limitations can help consumers make informed decisions about their financing options.

Understanding the Limitations

While Snap Finance offers accessible financing options, it is essential to recognize its drawbacks. Many users find that the costs associated with leasing can be significantly higher than traditional financing methods.

High Overall Costs

One of the primary concerns is that consumers often end up paying more than double the original purchase price. This high cost can lead to financial strain if not managed carefully.

No Credit Reporting

Another drawback is that Snap Finance does not report payments to credit bureaus. This means users miss out on opportunities to build or improve their credit scores, which can affect future financing options.

Lack of Transparency

The fee structure can also be unclear, leaving consumers uncertain about the total costs involved. Hidden fees for late payments or processing can add to the overall expense.

Potential for Debt

If payments are not made within the specified time, users may find themselves in a cycle of debt, making it challenging to regain financial stability. Understanding these risks is crucial for anyone considering Snap Finance.

Limited Availability

Not all retailers accept Snap Finance, which may restrict purchasing options for consumers.

Consumer Awareness

Being aware of the terms and conditions is crucial when using Snap Finance. Consumers should take the time to read through agreements to understand their obligations fully.

Understanding Fees

While Snap Finance prides itself on transparency, there may still be fees associated with late payments or other actions. Familiarizing oneself with these details can prevent unexpected charges.

Responsible Spending

Using Snap Finance requires a commitment to responsible spending. Consumers should evaluate their financial situations and ensure they can meet repayment obligations to avoid falling into debt.

Conclusion

In summary, Snap Finance offers a unique alternative to traditional financing methods. Its focus on flexible payment options and accessibility makes it an appealing choice for many consumers.

By eliminating credit checks and providing transparent terms, Snap Finance empowers individuals to make necessary purchases without the stress often associated with financial commitments. This approach fosters a sense of financial independence.

If you are considering financing options, exploring Snap Finance may be worthwhile. Understanding how it works and its benefits can help you make informed decisions tailored to your financial needs.

Take the time to evaluate your options and see how Snap Finance can fit into your purchasing strategy, allowing you to enjoy essential items without compromising your financial health.

Relate Articles

- How Does Snap Finance Work?

- Can I Use Snap Finance on Amazon? Let’s Find Out

- Does Snap Finance Check Your Credit? Uncover the Truth

- What Stores Accept Snap Finance?

- Does Snap Finance Help Build Credit?

- Does Ashley Furniture Accept Snap Finance?

- Big O Tires Snap Financing | Manage Unexpected Auto Expenses