In India, riding a bike is not just a mode of transport; it's a way of life. However, with this freedom comes the responsibility of ensuring that you are adequately protected. One crucial aspect of this protection is knowing how to check your bike insurance validity.

Many riders often overlook the importance of verifying their insurance status. Without proper knowledge, you could face hefty fines or worse—financial liabilities in case of an accident. Understanding the nuances of two-wheeler insurance rules can save you from unnecessary stress.

So, how do you ensure that your bike is covered? The process might seem daunting, but it’s quite straightforward once you know where to look. In this article, we will explore effective methods on how to check bike insurance validity in India, ensuring you're always on the right side of the law.

Join us as we delve into the essential steps on how to check bike insurance validity or expiry date in India, empowering you to ride with confidence and peace of mind.

Table of Contents

ToggleUnderstanding Bike Insurance in India

Types of Bike Insurance

When it comes to two-wheeler insurance, understanding the different types available is essential. Each type offers distinct coverage and benefits, catering to various needs of bike owners.

- Third-Party Insurance: This is the minimum legal requirement for all bike owners in India. It covers damages to third parties in case of an accident, protecting you from legal liabilities.

- Comprehensive Insurance: This type provides broader coverage, including damage to your own vehicle, theft, and personal accidents. It’s ideal for those seeking extensive protection.

Legal Requirements

The Motor Vehicles Act mandates that all two-wheelers must have at least third-party insurance. Riding without valid insurance can lead to significant penalties and legal repercussions.

Understanding these legal requirements can help you avoid fines and ensure that you are riding safely and responsibly. Being informed about the insurance information bureau can also assist in keeping your policy updated.

Why Checking Bike Insurance Validity is Essential?

Legal Compliance

Ensuring that your bike insurance is valid is not just a good practice; it is a legal obligation. Riding without valid insurance can lead to hefty fines and legal troubles.

Financial Protection

Valid bike insurance acts as a safety net. In the event of an accident or theft, having the right coverage can save you from significant financial losses.

Avoiding Complexities

Expired insurance can complicate matters. If you have an accident with an expired policy, you may lose your no-claim bonus and face challenges in claiming damages.

- Legal Penalties: Riding without insurance can lead to fines and potential legal action.

- Loss of Coverage: An expired policy means no financial protection in case of accidents.

- No-Claim Bonus Loss: You risk losing discounts on future premiums if your policy lapses.

Check Bike Insurance Expiry Date Online via VAHAN Portal

The VAHAN portal is a government initiative that allows you to check various vehicle-related details, including insurance status. It is user-friendly and accessible from any device.

Step 1: Visit the VAHAN Portal

Open your web browser and navigate to the VAHAN e-Services website. The official URL is typically parivahan.gov.in.

Step 2: Access Vehicle Details

On the homepage, look for the "Know Your Vehicle Details" option. This is usually found under the "Informational Services" or similar menu.

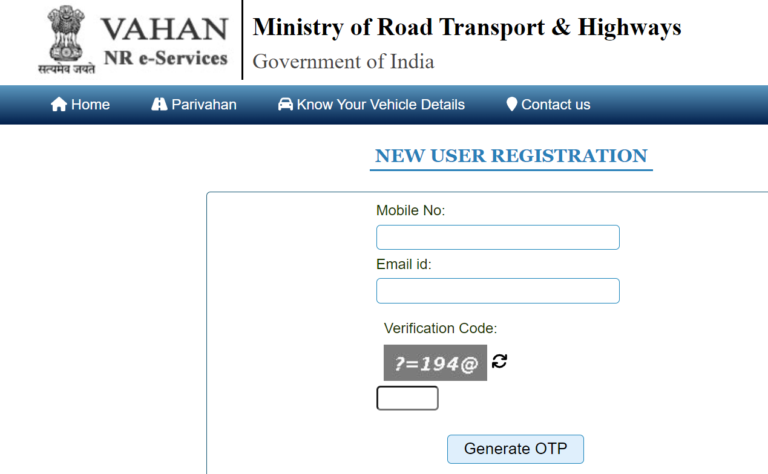

Step 3: Create Your Account

Click on "Create Account" and create your account on the portal by giving registered mobile number and email id.

Step 4: Enter Vehicle Information

You will be prompted to enter your bike registration number. Make sure to input it correctly without any special characters (e.g., KA01JG1234). Fill in any additional required fields, such as the verification code displayed on the screen.

Step 5: Generate OTP

After submitting your vehicle registration details, you may be asked to generate a One-Time Password (OTP). This OTP will be sent to your registered mobile number.

Step 6: Enter OTP

Check your mobile phone for the OTP and enter it in the provided field on the website. Click on "Verify" or similar to proceed.

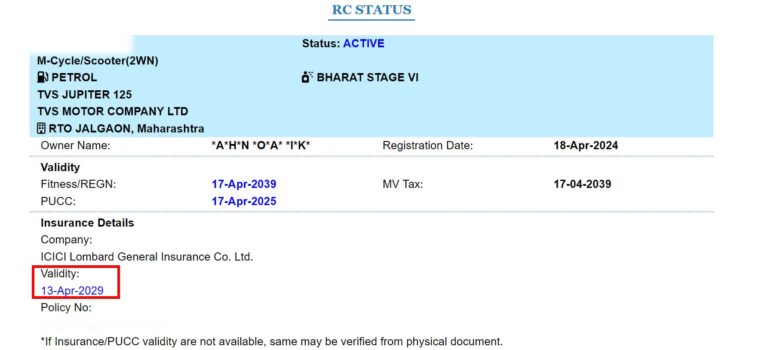

Step 7: View Insurance Details

Once verified, you will be redirected to a page displaying all relevant details about your bike, including the insurance expiry date.

Important Notes

- Ensure that you have access to your registered mobile number for OTP verification.

- The information on the VAHAN portal is updated regularly but may take up to two days after purchasing or renewing your insurance policy to reflect accurately.

- If you encounter issues, consider checking with your insurance provider or visiting your local RTO for assistance.

This process allows you to quickly and efficiently check your bike insurance status online through the VAHAN portal.

Check Bike Insurance Validity Date Online Via Insurance Information Bureau (IIB) Portal

The IIB provides a dedicated platform for checking insurance policies. This method is reliable and offers comprehensive information about your bike's coverage.

-

Visit the IIB Website:

Open your web browser and go to the official website of the Insurance Information Bureau.

-

Navigate to Quick Links:

On the homepage, look for the ‘Quick Links’ section.

-

Select ‘V Seva’:

Click on the ‘V Seva’ option. This will direct you to a new page specifically for checking insurance details.

-

Fill Out the Required Form:

You will see a form that needs to be filled out. Provide the following details:

- Name

- Address

- Bike Registration Number

- Any other required information as prompted.

-

Complete the Captcha:

Enter the captcha code displayed on the screen to verify that you are not a robot.

-

Submit the Form:

Click on the ‘Submit’ button after ensuring all details are correctly filled.

-

View Your Insurance Details:

After submission, your bike insurance policy details will be displayed. Look for the expiry date under the ‘Insurance Up to’ tab.

Additional Tips

- Ensure that you enter your bike registration number without any special characters.

- If your bike is new, it might take some time for its details to appear in the IIB database, as insurers may take up to two months to submit policy data.

- If you encounter any issues, consider checking with your insurance provider directly or using alternative methods like VAHAN or your insurer's website.

By following these steps, you can easily check your bike insurance expiry date online through the IIB portal, ensuring you stay informed about your policy status and avoid lapses in coverage.

Check Bike Insurance Validity Online Via Insurance Provider’s Website

Insurance Provider’s Website

Your insurance provider's website is another convenient option. Most insurers have online portals where you can check your policy status quickly.

- Log in to your account on the insurer's website.

- Locate the 'Policy Details' section.

- View your current insurance status and expiry date.

Methods to Check Bike Insurance Validity Offline

Visiting the RTO Office

If you prefer a personal touch, visiting your local Regional Transport Office (RTO) is a viable option. The staff can assist you in checking your bike insurance status directly.

- Gather necessary documents, including your bike's registration certificate.

- Visit the nearest RTO office.

- Request assistance from the staff to check your insurance validity.

Contacting Your Insurance Provider

Another straightforward method is to contact your insurance provider directly. Their customer service representatives can provide instant information about your policy status.

- Locate the customer service number of your insurer.

- Call and provide them with your policy number or vehicle details.

- Ask for confirmation of your current insurance status and expiry date.

Using Policy Documents

Your physical policy documents are also a reliable source for checking insurance validity. Always keep them handy for quick reference.

- Policy Number: Check the document for the policy number and expiry date.

- Insurer Contact Details: Use the contact information provided on the document for any inquiries.

Tips for Maintaining Valid Bike Insurance

Setting Reminders for Renewal

One of the simplest ways to ensure your bike insurance remains valid is to set reminders for renewal. This proactive approach can save you from lapsing coverage.

- Digital Calendars: Use apps or calendar features on your phone to set reminders a month before expiry.

- Email Alerts: Many insurers offer email notifications for upcoming renewals; make sure to subscribe.

Understanding Policy Terms

Before renewing your insurance, take the time to understand the terms and conditions. Knowing what is covered can help you make informed decisions.

- Coverage Limits: Be aware of the maximum amount your insurer will pay in case of a claim.

- Exclusions: Familiarize yourself with what is not covered under your policy to avoid surprises later.

Exploring Long-Term Policies

If you find yourself frequently renewing your insurance, consider opting for a long-term policy. This can provide peace of mind and often comes with added benefits.

- Discounts: Many insurers offer discounts for long-term policies, making them more economical.

- Continuous Coverage: A long-term policy reduces the risk of accidental lapses in coverage.

Frequently Asked Questions - FAQS

Q. How can I get a reminder for my bike insurance renewal?

A. You can set up reminders for your bike insurance renewal through your insurance provider's website or app. Many insurers offer automated alerts via email or SMS to notify you before the due date.

Q. Is there a discount for renewing bike insurance before the expiry date?

A. Yes, many insurers provide a discount or No Claim Bonus for renewing your bike insurance before the expiry date, encouraging timely renewals to maintain continuous coverage.

Q. Can I renew my bike insurance online without visiting the insurance company office?

A. Absolutely, you can easily renew your bike insurance online through your insurer's website. The process is designed to be quick and convenient, eliminating the need for an office visit.

Q. What documents are required to renew bike insurance online?

A. Typically, you will need a copy of your previous insurance policy and the certificate of registration of your bike to complete the online renewal process.

Q. How can I avoid paying a late fee for bike insurance renewal?

A. To avoid late fees, set up reminders and renew your policy well in advance of the expiry date. Consider opting for long-term coverage to minimize yearly renewals.

Q. Can I transfer my bike insurance to a new owner?

A. Yes, transferring your bike insurance to a new owner is possible. The new owner must apply for the transfer with the insurer, providing necessary documentation to complete the process.

Q. Is it mandatory to renew bike insurance annually?

A. Generally, it is mandatory to renew your bike insurance annually as per legal requirements. However, some insurers offer longer-term policies for added convenience.

Q. Can I renew my bike insurance for more than one year?

A. Yes, many insurers allow you to choose multi-year policies for your bike insurance, providing coverage for up to three or five years at once, which can also save on premiums.

Q. How can I change my bike insurance plan during renewal?

A. During renewal, you can review available plans and select a different policy that better suits your needs by comparing options on your insurer's website or app.

Q. Can I get a refund of unused premium if I cancel my bike insurance before the expiry date?

A. Yes, if you cancel your bike insurance before the expiry date, you may be eligible for a proportional refund of the unused premium based on the terms of your policy.

Q. How can I check the coverage details of my bike insurance policy?

A. You can check the coverage details by logging into your account on the insurer's website or app, where all relevant policy information will be available for review.

Q. What is the difference between third-party liability and comprehensive bike insurance?

A. Third-party liability covers damages to others in an accident caused by you, while comprehensive insurance includes both third-party liabilities and damages to your own vehicle from various risks.

Q. What are the factors that affect bike insurance premium?

A. Factors influencing your bike insurance premium include your age, driving history, type of vehicle, location, and any previous claims made under your policy.

Q. Can I claim bike insurance for theft if I have not registered the vehicle?

A. Generally, claiming theft under bike insurance requires registration of the vehicle; without it, claims may not be honored as registration is essential for validation.

Q. What is the process for claiming bike insurance in case of an accident?

A. To claim bike insurance after an accident, notify your insurer promptly, provide necessary documentation like police reports and photographs, and fill out a claim form as instructed by them.

Q. How long does it take to settle a bike insurance claim?

A. The time taken to settle a bike insurance claim varies but typically ranges from a few days to several weeks depending on documentation completeness and claim complexity.

Q. Can I claim bike insurance for damages caused by natural disasters?

A. Yes, if you have comprehensive coverage, you can claim damages from natural disasters such as floods or storms as long as these risks are covered in your policy terms.

Q. Is there a waiting period for certain bike insurance claims?

A. Yes, some policies may impose a waiting period before specific claims can be made, particularly related to pre-existing damages or conditions outlined in the policy agreement.

Q. What is the difference between own damage and third-party damage in bike insurance?

A. Own damage refers to losses incurred by your own vehicle due to accidents or incidents while third-party damage covers liabilities arising from damages caused to another party's property or person.

Q. Can I claim bike insurance for accessories installed on my bike?

A. Yes, many policies allow claims for accessories if they are declared when purchasing coverage; ensure they are included in your policy details for successful claims.

Conclusion

Recap of Key Points

In summary, checking your bike insurance validity is crucial for legal compliance and financial protection. Understanding the different types of policies helps you choose the right coverage for your needs.

Importance of Regular Checks

Regularly verifying your insurance status can prevent complications down the road. Whether through online portals or direct contact with your insurer, staying informed is essential.

Take a moment today to check your bike insurance validity. By being proactive, you can ride with confidence, knowing that you are adequately protected on the road.